The Living Trust

Updated: December 29, 2022

A living trust is created while you’re alive. They are sometimes called family trusts.

- Living trusts can be revocable (able to be altered or dissolved) or irrevocable (cannot be changed).

- They allow the transfer of assets to your family during your lifetime. For bank accounts in your living trust, the Federal Deposit Insurance Corporation (FDIC) protects up to $250,000 per bank account for each named beneficiary. For example, if you have three beneficiaries, each bank account in your trust is protected up to $1,000,000.

- Once a valid living trust is created it is valid in every state, not just the state in which it was created.

- There are many versions of each, so use a professional such as an estate lawyer or other type of estate planner.

The first decision to make is whether or not you need a living trust at this point in your life or ever.

- You may be too young or not wealthy enough for any of the benefits, such as avoiding probate or estate taxes, to be a consideration at this time.

- You may be married but have no children, and be able to use less expensive and complicated ways to leave your estate to your spouse such as joint ownership, payable on death accounts, or transfer on death deeds.

Considerations When You Are Choosing Which Type of Living Trust to Create

- If you prefer to keep your assets under your personal control while you are able to or have them managed by a trustee during your lifetime. If you choose another trustee, they could be a family member, friend, or professional such as a bank or a trust company.

- If you want to protect your assets from creditors by giving up legal ownership or have them available to creditors by keeping legal ownership.

- If your estate is worth enough to need protection from federal estate taxes (over $12,920,000 in 2023).

- If you live in one of the 13 states that have their own estate taxes (more than $1,000,000-$12,920,000 depending on your state).

- If you want your children and/or grandchildren to be the ultimate owners of your estate.

Family Trust

A family trust is not a specific type of trust but is any trust you create that names your family members by blood, marriage, or law (in the case of adoption) as the beneficiaries — not just your spouse like A-B or ABC Trusts. The name can be confusing because some use the term almost interchangeably with Living Trust. However, both a living trust and testamentary trusts are Family Trusts if they only designate family members as beneficiaries.

Irrevocable Living Trust

When a living trust is irrevocable it means after the trust agreement has been formed, signed, and funded you will not be able to revoke (end) the trust or alter any of the existing conditions in the trust. A living trust could become irrevocable if you become unable to manage it while alive and becomes irrevocable when you die.

When a living trust is irrevocable it means after the trust agreement has been formed, signed, and funded you will not be able to revoke (end) the trust or alter any of the existing conditions in the trust. A living trust could become irrevocable if you become unable to manage it while alive and becomes irrevocable when you die.

You can set up an irrevocable living trust right from the beginning. Aside from asset protection and lowering of estate taxes, you may have personal reasons to opt for this such as an illness that may eventually impair your judgment.

You are not allowed to be a trustee of an irrevocable living trust and you will give up rights and control of your property and other assets in it.

You can add assets but unlike a revocable living trust you are not allowed to remove assets, take property back after you’ve put it in, or remove any beneficiaries if circumstances change.

Since you are not legally considered the owner, your assets will be protected from creditors before and after you die.

- How well protected the assets are may depend on your state provisions, although bypassing probate affords some protection as well.

- This is sometimes called an asset protection trust (APT), but an APT is a specific type of trust described below.

An irrevocable living trust has its own taxpayer identification number, unlike a revocable trust where the trust and its trust maker share the same Social Security number.

There may be tax advantages.

- Since the trust has its own taxpayer identification number, any gains from the trust are not included in your income for tax purposes.

- Since your assets have been permanently removed from your possession, federal estate taxes can be minimized or completely avoided if your estate would otherwise have been over the 2023 federal limit of $12,920.000.

- This may not be true if you live in one of the 13 states with state-specific estate taxes, so check with a specialist familiar with the rules in your state.

This does not prevent you from qualifying for Medicaid benefits if you require skilled nursing care. Medicaid has a “look-back” period to past assets, so the timing of the trust’s formation is important.

Setting up the trust to defraud creditors can result in a court declaring the transfer of assets to a trust to be fraudulent and exposure of the trust assets to liability. You could face heavy legal penalties.

There are ways to make changes but they usually need to be part of the initial trust agreement and signed by the trustees and all beneficiaries, including any contingent beneficiaries.

There are ways to make changes but they usually need to be part of the initial trust agreement and signed by the trustees and all beneficiaries, including any contingent beneficiaries.

- The provision is called a lifetime or testamentary power of appointment.

- Charitable trusts usually contain such provisions to allow modification of the trust agreement to comply with changes in federal tax or other laws.

- Although the trust would still exist If the assets in it were sold or otherwise disposed of, it would be worthless and essentially revoked.

There are options to account for any unforeseen problems with an irrevocable trust that impede its original intent.

- In some states trustees and/or beneficiaries can petition the court for a judicial modification of a trust order if circumstances change and the administration of an irrevocable trust becomes unreasonably expensive or if its purpose has become outdated. This order can be used to modify or completely terminate the trust according to your state’s trust law.

- Generally state law requires certain conditions to be met before any amendment or revocation can take place with substantial variation among state trust codes.

- A provision can be made for a trust protector, an independent third party appointed by the trustee, the trust beneficiaries, or a court. The protector has the ability to examine the facts and circumstances for desired change to the trust and make a final determination as to whether the change should be made.

- There may be more complicated means that require a professional.

- You may be able to take advantage of imprecise language in the trust to distribute assets to a new trust with different language in a process called decanting.

- Some irrevocable trusts allow a swap of assets from the trust.

Asset Protection Trust

Although most irrevocable trusts can protect your assets from creditors, lawsuits, or any judgments against your estate, an asset protection trust (APT) or self-settled asset protection trust is more effective since it is set up specifically to do this. This happens because your assets are permanently transferred into the trust and now belong to the trust. Assets can include cash, securities, limited liability companies (LLCs), business assets, and recreational possessions such as planes and boats.

APTs created in the United States have more flexible asset-protection than other irrevocable trusts.

- You may want to do this if you are a physician or lawyer and potentially subject to malpractic

e suits, you own a business, or are in any other profession or situation that puts you at increased risk for accidents, injuries, lawsuits, or other judgements.

e suits, you own a business, or are in any other profession or situation that puts you at increased risk for accidents, injuries, lawsuits, or other judgements. - They are expensive and complicated to create, but if done properly the trust may deter potential creditors or plaintiffs from pursuing any action. Make sure you consult a professional skilled in their creation.

When creating a self-settled asset protection trust there are five things you and your attorney will need to consider.

- Which creditors do you want to protect your assets from?

- Your reasons for creating the trust can’t be to avoid current creditors.

- The trust can shield your assets only from potential future creditors, and some states have a waiting period. For example, if you create a trust and 6 months later a court issues a judgment against you, the assets may not be protected.

- The APT does not protect against obligations like child support, alimony, or spousal support, taxes, “necessary services or supplies” like some medical services, and many court judgments against you.

- Which state’s laws will be the most beneficial for your trust?

- You have the option of setting up an APT in any state you choose that allows them, despite your state of residence.

- You are not guaranteed to win a lawsuit or judgment against your estate, but it is most likely if the court hearing takes place in the state the APT was created.

- Who will be the trustee of the APT?

- An APT is irrevocable and you cannot be the trustee. You will not be able to remove any of the assets yourself.

- You should choose an individual or corporate trustee who resides in the state where the trust is created and is familiar with the laws in that state.

- Which assets do you want to put in the trust?

- You may have to move assets to the state where you are creating the trust. If the assets are cash, stocks, or bonds, that may be easy to do.

- Since you can’t move real estate to a different state, it is difficult to protect real estate, particularly if the property is located in a state that does not allow this type of trust.

- What access do you expect to the trust’s assets?

- The trust document will limit your access to funds.

- You will be designated as a permissible beneficiary and may be allowed access to the assets in the trust through discretionary payments of income and/or principal from the trust if they are approved by the trustee.

- APTs also contain a spendthrift clause preventing you from selling, spending, or giving away trust assets without specific instructions.

- If you want, other members of your family, such as your spouse, children, or grandchildren may also be eligible for discretionary distributions.

There are two basic types of APTs depending on where the trust is located.

- A domestic APT is held in an institution in the United States.

- At least seventeen states allow domestic APTs: Alaska, Delaware, Hawaii, Michigan, Mississippi, Missouri, Nevada, New Hampshire, Ohio, Oklahoma, Rhode Island, South Dakota, Tennessee, Utah, Virginia, West Virginia, and Wyoming.

- APTs can be set up for a broad range of assets or for a single purpose, such as asset protection for Medicaid planning or asset protection for a special needs beneficiary.

- Since your assets are in the U.S., they are still subject to the legal system. This puts them at the risk of court orders such as liens or judgments, federal bankruptcy laws, and various state laws.

- A foreign APT, also known as an “offshore” trust, is held in an offshore account and not under the jurisdiction of the U.S.

- They are usually more expensive than domestic APTs, but have more strict privacy measures. They offer even more effective protection for your assets since the holder would not be required to disclose the existence of the trust.

- They usually do not enforce U.S. judgments against assets of trusts held in foreign jurisdictions. Even if a creditor wins a lawsuit against you in a U.S. court, there is no way for them to collect against your trust.

Credit Shelter Trust

A credit shelter trust is not a living trust or even a single type of trust but trust options that will provide for your surviving spouse while arranging to have your descendants or adopted children inherit part of your estate while sheltering them from creditors, lawsuits, and estate taxes up to a certain limit.

A credit shelter trust is not a living trust or even a single type of trust but trust options that will provide for your surviving spouse while arranging to have your descendants or adopted children inherit part of your estate while sheltering them from creditors, lawsuits, and estate taxes up to a certain limit.

A bypass trust transfers ownership directly to your children while most marital trusts will split into an irrevocable bypass trust for your children and a revocable trust for your surviving spouse.

Bypass Trusts

Bypass trusts, such as a Qualified Terminable Interest Property Trust, are irrevocable trusts that benefit your surviving spouse by providing income from the trust’s assets and ensure that your children receive their inheritance.

- To protect the assets for your children your surviving spouse has only limited access and rights to control the funds in the trust. They are entitled to any income specified in the trust for the rest of their life, otherwise known as a life estate. You may give them the option to use some of the principal under specific circumstances, such as the need to fund certain medical, educational, or maintenance expenses.

- While your surviving spouse can serve as trustee, ownership usually bypasses your spouse and another trustee is appointed. Ownership transfers to your children or other familial beneficiaries after the death of your spouse.

This is more commonly done with spouses who are not a parent of your children, who would probably not be the trustee.

Marital Trusts

There are a number of choices for couples covered in detail in the Trusts for Married Couples section.

- Dividing trusts, such as an A-B trust and an ABC trust, are revocable living trusts that split upon your death. Your spouse’s part, the A trust, is theirs to manage. The family or B trust becomes a by-pass trust that the children eventually receive. The B trust is irrevocable. Your spouse could be the trustee and may have restricted access to the assets. For example, they may be able to get income from the trust for a specified period of time.

- Dual trusts are a combination of two trusts created in your will, an irrevocable bypass trust for your children and marital/personal trust for your surviving spouse.

Because two trusts are formed at your death and each could contain up to the $12,920,000 estate tax limit, twice the estate tax limit would be tax free.

Insurance Trust

A settlement from a life insurance policy can be subject to estate taxes if it pushes your assets over the federal and/or state maximum. One way to avoid this is to make sure you name a beneficiary for the policy who will receive the settlement after your death. You can make the beneficiary the owner of the policy, but there are a number of potential issues associated with that such as them making changes you won’t want or dying before you.

A settlement from a life insurance policy can be subject to estate taxes if it pushes your assets over the federal and/or state maximum. One way to avoid this is to make sure you name a beneficiary for the policy who will receive the settlement after your death. You can make the beneficiary the owner of the policy, but there are a number of potential issues associated with that such as them making changes you won’t want or dying before you.

Another way is to create an insurance trust. An insurance trust is a trust set up to own or hold title to your life insurance policy. It can be done with term or permanent life insurance. This works with both individual and second-to-die life insurance policies which insure two lives, usually spouses, and only pay a death benefit after the second spouse dies.

If you already have a life insurance policy, you can transfer the policy to the trust after it’s been formed.

- You are not the owner so the trust is irrevocable and protects the settlement from estate taxes, even if you are the beneficiary of the policy.

- If you die within three years of setting up the trust, the IRS will include the settlement in your estate for estate tax purposes.

If you do not have a life insurance policy, you can create the trust and use it to purchase the policy directly.

- By using the trust to take out a new policy, you avoid the three year provision.

- If the trust helps avoid estate taxes, you may be able to save money by buying a smaller policy which accounts for the tax savings.

In addition to the policy, you will need to fund the trust with enough money to pay the premiums.

- Premium payments need to come from the trust, not from other accounts.

- If you only add enough money to pay the premiums, it is termed an Unfunded Life Insurance Trust.

- Adding more funding to the trust will make it a Funded Life Insurance Trust.

- The additional money to either trust is considered a gift to the beneficiaries and subject to the gift-tax laws if they do not have immediately right to any money put in the trust.

- In 2022 the gift-tax exclusion limit is $17,000 per beneficiary per year.

- Crummey provisions (see below) allow you to put up to that amount in the trust if the trustee sends out an annual Crummey Letter to inform the beneficiaries of the deposit, that they have the immediate and unrestricted right to withdraw those assets, and the length of time they have to withdraw it.

Once your life insurance policy is in the trust, you will either choose a beneficiary or consider changing them. It is best if you name the trust itself as the beneficiary. This is separate from naming a beneficiary of the trust.

Once your life insurance policy is in the trust, you will either choose a beneficiary or consider changing them. It is best if you name the trust itself as the beneficiary. This is separate from naming a beneficiary of the trust.

- This allows the settlement to go directly into the trust to benefit the beneficiaries named in your trust document, usually your spouse or children.

- Choosing another beneficiary can create problems.

- If the settlement, as opposed to the trust, goes directly to a beneficiary, it becomes part of their taxable estate even if used to pay estate taxes.

- The courts will become involved if:

- The beneficiary becomes incapacitated and the insurance company does not pay out the settlement; and/or

- The beneficiary dies before you and leaves the policy without a beneficiary.

Insurance trusts have additional benefits.

- You can include specific instructions on how the settlement is distributed and used. For example: rather than a lump sum that would happen if you simply named a beneficiary, you can designate that the settlement be spread out over time in any way or for any reason that is spelled out in the trust.

- As long as your beneficiary is not your estate, the probate court will not be involved.

- The settlement is protected from your creditors if the trust is irrevocable.

- The trust becomes irrevocable after your death, no matter how it was set up while you were alive.

- If your beneficiary retains the trust, it would not be available to their creditors or taxed as part of their estate when they die.

- This would not be if the trust was distributed and closed by the trustee.

- It won’t prevent your beneficiary from receiving benefits from a government program such as Medicaid.

You will usually create your trust as an Irrevocable Life Insurance Trust (ILIT).

- As with any irrevocable trust, you are not able to appoint yourself as the trustee and will need to choose one.

- You could name a spouse, your adult children, a friend, an attorney, or a financial institution.

- Your trustee will not be able to make any changes, such as transferring it back to you or changing beneficiaries.

- Other considerations include:

- You won’t be able to borrow against the cash value of the policy or seek a viatical settlement;

- The trust will still exist after your death and can be used to pay estate costs instead of having to liquidate other assets to do it; and

- Although irrevocable, if you stop the premium payments for the life insurance policy, the trust will be worthless after the cash value of the policy has been used up.

Although not recommended, you may opt to create your insurance trust as a revocable trust with you as the trustee.

- This gives you incidents of ownership that allows you to have control over the policy. It will allow you to withdraw its cash value, change its beneficiaries, or dissolve the trust at any point during your lifetime.

- Since you are considered the owner of the trust, the settlement will be considered part of your estate and subject to estate tax and available to your creditors.

- It’s a complicated process best done by a professional.

Crummey Trust

A Crummey trust, Crummey provisions, or Crummey power, are ways to give gifts that qualify for gift-tax exclusion and still control how the gift is used. This can be especially useful for minor children as an alternative to a Custodial Account (a brokerage or savings account managed by an adult conservator for the children until they reach the age of maturity) since a trust is more flexible and can control when and how beneficiaries can use the assets.

A Crummey trust, Crummey provisions, or Crummey power, are ways to give gifts that qualify for gift-tax exclusion and still control how the gift is used. This can be especially useful for minor children as an alternative to a Custodial Account (a brokerage or savings account managed by an adult conservator for the children until they reach the age of maturity) since a trust is more flexible and can control when and how beneficiaries can use the assets.

These gifts are in the form of additions to an irrevocable trust.

- A Crummey trust is a trust set up specifically for a gift.

- While gift-tax exclusions do not usually apply to gifts made to trusts, Crummey provisions or power added to another type of irrevocable trust, most commonly an insurance trust, allow additions to the trust to be eligible for gift-tax exclusion.

- These additions are subject to the gift tax limitations, currently $17,000 per person per year. Married couples filing jointly can gift twice this amount per person.

There are specific actions that need to be taken to make contributions to a trust eligible for gift-tax exclusion.

- The Crummey provisions must be part of the trust when it is created.

- The beneficiaries must have access to newly added funds for at least 30 days. It is the ability of the beneficiaries to have an immediate right to the money that makes the addition eligible for the exemption.

- When the trust is created or money is added to the trust, the trustee must send a letter to advise beneficiaries that they can access the money within that specific period of time.

- The exemption will only apply if the beneficiary accepts the funds during the 30 day period and declines to withdraw any of the gift.

- Withdrawing money will also reduce the amount of earnings the funds can accumulate long-term. For these reasons, the beneficiaries:

- Are usually informed that the addition was intended to be made for this purpose; and

- May be informed that no other additions will be made if they do.

Qualified Personal Residence Trust

A qualified personal residence trust (QPRT) allows you as a homeowner to reduce estate taxes by removing the value of your primary and/or secondary house along with the land and all future appreciation from your assets or joint assets with your spouse. A QPRT is most useful if you have a residence that you would like to keep in the family.

You can create two QPRTs if you want to protect both your primary and secondary residence, one for each. Initially, the residence will be in the trust. Once the trust ends your beneficiaries will have ownership and the house stays in your family, although you cannot buy it back.

The process involves creating an irrevocable trust with your children as beneficiaries and funding it by transferring ownership of your property to the trust.

The process involves creating an irrevocable trust with your children as beneficiaries and funding it by transferring ownership of your property to the trust.

- Transferring ownership is done by filing a new deed with the name of the trust with the land records department where the property is located.

- You will need a formal real estate appraisal to assess the fair market value of the property to establish the value of the trust for gift tax purposes.

- The trust will be managed by a trustee other than you and/or your spouse.

- You will want to include successor trustees.

Terms of the trust

You (and your spouse) have the right to live in the house rent free for the “retained income period,” i.e. the specified period of time chosen when the trust was created. This phase needs to be long enough for a financial benefit and short enough to reduce your risk of dying during it.

The house then goes to the designated beneficiaries or a trust in their name. As before, this is usually done by making a new deed with the names of your beneficiaries or their trust. You are now their tenant. This is called the “remainder interest” phase. You will begin to pay fair market rent if you stay in the house full-time or when you stay there at times. The rent payments:

- Will gradually reduce the value of your estate for estate tax purposes;

- Are taxable income for your beneficiary; and

- Do not count as a gift and therefore do not affect the annual or life-time non-taxable gift limit. This allows you to give additional gifts to your beneficiaries without worrying about additional estate or gift tax.

While this sounds like a good financial plan, there are many factors to consider.

- With the 2023 federal estate limit at $12,920,000 and scheduled to increase for inflation until December 2025, most homes are unlikely to push your estate over the limit. This may not be true of the state estate taxes, which can be as low as $1,000,000.

- Even though the trust owns the house, you are still paying property and/or real estate taxes on the house.

- You can deduct them from your taxes.

- This stops when the ownership transfers to your beneficiaries.

- You are responsible for upkeep of the property. Funds can be added to the trust for home repairs, maintenance, insurance, and taxes, but the money must be used within 6 months.

- When transferred to your beneficiaries or when the trust expires, the property is considered a gift and subject to gift tax limits.

- The trust has ownership, so any appreciation of the value of the property is not considered a gift from you. For gift tax purposes the value of the property at the end of the retained income period is the fair market value when the trust was formed, not when was transferred.

- The gift value of the property is the fair market value minus the yearly limit the year the trust was created ($17,000 in 2023) multiplied by the duration of the retained income period. For example:

- If you put your residence in a QPRT for 15 years, you could gift $255,000 (15 times $17,000) without gift tax consequences;

- If your house is worth $1,000,000, your “gift” would be $745,000 over the tax-free limit ($1,000,000 minus $255,000); when you die, estate taxes would be owed if your estate was worth more than $12,175,000 ($12,920,000 minus $745,000).

- The trust locks in these figures, so this will not change even if the gift tax limits change or the value of your property changes.

- You will need to file a United States Gift (and Generation-Skipping Transfer Tax) Return (Form 709) with the IRS by April 15 of the year after you funded the trust, in addition to a state gift tax return if you live in a state that also has a state gift tax.

- If there is a mortgage, the principal portion of the mortgage payments are considered gifts that count against the $16,000 yearly gift tax exemption. The interest portion is still tax deductible.

- Using the above example, if you paid $250,000 in mortgage principal, that is considered a gift during that 15 years since the value of the trust already exceeds the gift limit. You would owe estate taxes if your estate was worth more than $11,734,000 ($11,984,000 minus $250,000).

- Gift tax returns will need to be filed for any years that amount is exceeded.

- Since the trust is the owner of the home:

- You cannot obtain a second mortgage or use it as collateral;

- You cannot qualify for any property tax benefits; and

- It is more complicated to try and sell it. You are limited to either:

- Using the money to buy a new home which will be owned by the trust; or

- Receiving the money from the sale in the form of an annuity if you don’t wish to buy a new home.

- If you die during the retained income period of the trust the QPRT is essentially voided since the house would automatically reverts to your estate at the current fair market value based on Applicable Federal Rates that the Internal Revenue Service (IRS) provides.

- The assets were considered a gift when the trust was formed and will still count toward the life-time non-taxable gift limit, as would any mortgage payments considered a gift.

- Be sure you are realistic when choosing the length of the retained income phase.

- This would happen if you don’t pay the rent or otherwise follow the terms of the trust.

- As an incentive to keep the residence in the family, if your beneficiaries want to sell the house after you die, they will owe capital gains tax based on the difference between the selling price and the fair market value of the house when the trust was formed. Using the above example, if you die 5 years after your beneficiaries took ownership of the house and over that time the fair market value of that house doubled, they would pay capital gains on $1,000,000 if the house sold at $2,000,000; more if they’re able to get more for the house.

Miller (Qualifying Income) Trust

A Miller Trust has a single purpose: to allow Medicaid recipients with a gross income over your state’s Medicaid limit to be eligible for long-term care to qualify for nursing home benefits or Home and Community Based Services (HCBS) benefits when you would otherwise be unable to afford them.

Miller Trusts are not necessary in those states that allow Medicare recipients to qualify for these benefits by spending down income over the state’s limit on medically related expenses. Arkansas, Florida, Iowa, Kentucky, New Jersey, and Tennessee (minors only) allow both.

An alternative is a Pooled Income Trust, only available in a few spend down states. This is a type of charity trust created by non-profit organizations for disabled individuals, mainly disabled minors, that allow them to qualify for Medicaid.

Even if you qualify by income, you may have too many resources or assets to qualify for Medicaid. In this case, all states allow you to qualify by putting your assets into a first-party special needs trust.

States Categorized as “Medically Needy” or “Spend Down”

Thirty-two states are “medically needy” or “spend down” states where Miller Trusts are not needed to qualify for these benefits if you are unable to afford them.Medicaid recipients who are over the income plus assets limit can qualify for these services by spending all of these “excess” assets on medical care expenses and other approved items.

Thirty-two states are “medically needy” or “spend down” states where Miller Trusts are not needed to qualify for these benefits if you are unable to afford them.Medicaid recipients who are over the income plus assets limit can qualify for these services by spending all of these “excess” assets on medical care expenses and other approved items.

- It can be thought of as a deductible to be paid before services are paid for by Medicaid.

- Assets that are spent down in other ways violate the rules and will result in being denied for payment of these expenses.

- Medicaid has a look-back period in which all your past transfers are reviewed. If you have gifted assets or sold them under fair market value during this timeframe, you will have a period of Medicaid ineligibility.

Assets counted towards the asset limit are cash and liquid assets easily converted to cash, including:

- Bank accounts (checking, money market, savings);

- Vacation houses and property other than your primary residence:

- 401K’s and IRA’s not in payout status (payout status only applies in some states); and/or

- Mutual funds, stocks, bonds, and certificates of deposit.

Assets not counted towards the asset limit include:

- Your primary home;

- Pre-paid burial and funeral expenses;

- One automobile;

- Term life insurance;

- Life insurance policies with a cash value no greater than $1,500 (this limit can be the combined face value of multiple small life insurance policies);

- Household furnishings/appliances;

- Personal items, such as clothing and engagement/wedding rings; and/or

- Assets held in irrevocable trusts or Asset Protections trusts.

Allowable Medicaid spend down items as of September 2022 include:

- Accrued debt such as personal and vehicle loans, mortgages and credit card balances;

- Medical devices not covered by insurance such as dentures, eyeglasses, and hearing aids;

- Home modifications such as home repairs and modifications to improve access and safety, as well as additions to your existing home to make it easier to live in such as a first floor bedroom or bathroom;

- Vehicle repairs such as replacing the battery, getting an engine tune-up, replacing old tires, and/or selling an existing car at fair market value and purchasing a new one;

- A Family Caregiver Contract between an elderly individual and a caretaker, usually a family member, where the caretaker is compensated on a monthly basis for providing care;

- Life Care Agreements which are formal contracts between an elderly individual and a caretaker, typically a family member or close friend where the caregiver is paid a lump sum for agreeing to care for the senior for their life expectancy;

- Purchase of annuities; and/or;

- Purchase of an irrevocable funeral trust up to $15,000 per spouse. This amount varies by state.

Each state may have their own name for the program and income limits. Medically needy states include Arkansas, California, Connecticut, District of Columbia, Florida, Georgia, Hawaii, Illinois, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Montana, Nebraska, New Hampshire, New Jersey, New York, North Carolina, North Dakota, Pennsylvania, Rhode Island, Tennessee and Texas (children and pregnant women), Utah, Vermont, Virginia, Washington, West Virginia, and Wisconsin.

In Arkansas, Florida, Georgia, Iowa, Kentucky, and New Jersey this option is only available to those who are vision impaired, disabled, or over 64 years old (i.e. eligible for Medicare).

States Categorized as “Categorically Needy” or “Income Cap”

Twenty-five states are “categorically needy” or “income cap” states where Miller Trusts can be used to qualify for these benefits.

Twenty-five states are “categorically needy” or “income cap” states where Miller Trusts can be used to qualify for these benefits.

- Miller Trusts may be called Medicaid Income Trusts, Income Diversion Trusts, Income Cap Trusts, Irrevocable Income Trusts, Income Trusts, d4B trusts, or Income Only Trusts.

- Some states require that you be 65 years or older and/or blind or disabled to qualify for a Miller Trust.

- Income cap states include Alabama, Alaska, Arizona, Colorado, Delaware, Florida, Georgia, Idaho, Indiana, Iowa, Kentucky, Mississippi, Missouri, Nevada, New Jersey, New Mexico, Ohio, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Texas, and Wyoming. Although they are spend down states, Arkansas, Florida, Georgia, Iowa, Kentucky, and New Jersey also allow Miller Trusts.

- If you put enough income into the trust to bring your remaining gross income below the limit, typically 300% of the Federal Benefit Rate — $2,742 in 2023 — you will qualify for these benefits.

- In 2023 this:

- $914 per month for eligible individuals;

- $1,371 for eligible couples; and

- $458 for an essential person/caretaker.

- In most cases you will only need to set up a Miller Trust if you need or will soon need this type of care, but they can be used to allow you qualify for Medicaid. You may consider a Miller Trust if you are just under the limit if it is possible your monthly income will occasionally exceed the limit.

- The trust is not meant to protect/shelter assets in general, but to make more funds available to pay for medical and other allowed expenses by allowing you to qualify for Medicaid. In fact, any funds left in the trust after your death goes to your state’s Medicaid program.

- You can put any percentage of your earnings into the trust account that exceeds the limit.

- The limit is based on your gross income, not your net income or take-home pay.

- You should continue doing this every month, especially if you are currently receiving care.

- Some income sources, such as your pension or social security check, must be put entirely into the account if you choose to add them.

- Existing assets and other income such as your community spouse’s income, VA benefits, income tax rebates, and some annuity payments cannot be added.

- You, your guardian, or power of attorney may set up the trust.

- You cannot be a trustee, but they can be a relative such as an adult child or a professional. This trustee manages the trust according to the guidelines established by the trust.

- Requiring the funds to be directly deposited into the trust;

- Having a minimum income requirement or limit on “excess” income before you can consider using a Miller Trust;

- Restricting the monthly amount of income that can be deposited into a Miller Trust; and/or

- Requiring all income to be deposited into the trust.

- You can pay yourself a monthly personal needs allowance (PNA). This amount varies by state and the long-term care setting. This amount varies by state and the long-term care setting.

- If you are married and your non-applicant spouse (community spouse, healthy spouse, or well spouse) has little to no income, you may pay them a monthly maintenance needs allowance. The figure varies by state and by circumstances, but the maximum payout in 2023 is $3,715.50 per month.

- If you are in a nursing home or have HCBS services, any funds remaining after paying any needs allowance are applied to those expenses. If you do not, the funds can be used for other medical costs and care expenses.

Revocable Living Trust

When a living trust is revocable it simply means that the trust can be revised, closed, or have assets added or taken from the trust at any time. If the trust is closed (revoked), your assets are transferred back to you.

When a living trust is revocable it simply means that the trust can be revised, closed, or have assets added or taken from the trust at any time. If the trust is closed (revoked), your assets are transferred back to you.

Unlike an irrevocable trust, a revocable living trust doesn’t have its own taxpayer identification number, it has the same Social Security number as you.

There are two or three phases to a revocable trust.

- The first phase begins after the trust agreement has been formed, signed, and funded. It will last as long as you’re mentally competent during which time you will own the trust and be able to manage it at your own discretion. Because of this, the trust assets are available to creditors and gains are taxable income.

- You will continue to use your assets as you normally would have before the trust such as selling, mortgaging, refinancing, gifting, or otherwise handling and using the property. The only difference is you are making transactions as a trustee and not a private owner.

- Most of the time you will be the initial trustee. If you are married, your spouse would be able to be a co-trustee if you have a joint trust.

- When you die, it will need to be specified whether your surviving spouse will become the manager of the trust (keeping it revocable) or another trustee is designated (usually making it irrevocable).

- A second phase may begin if you become incapacitated and your successor trustee takes over.

- If you did not have a joint trust with your spouse, you can add provisions in the trust document to keep the trust as revocable by stipulating in the trust document that your successor trustee may revise the trust with a Power to Amend Revocable Living Trust Agreement or a Testamentary Power of Appointment.

- With these powers they can determine how they want to manage the trust within the guidelines you provide in the document.

- The more specific you are about these guidelines, the more likely any changes will be made in accordance with your wishes.

- If you do not have a successor trustee and become incapacitated, the assets could end up in probate court and your loved ones and your property would be subject to the restrictive rules of guardianship or conservatorship and would not move on to the next phase.

- The last phase, which may also be the second phase, begins after your death when the trust automatically becomes irrevocable and the trustee begins to manage and settle the trust. This happens without involving the probate court and all the benefits that come from avoiding the probate process.

Totten Trust

A Totten Trust is a revocable living trust that is a type of payable-on-death account. You can easily set one up without a formal written document. However, it can be established as a formal trust by naming a beneficiary on the title document for the account using language such as “In Trust For,” “Payable on Death To” or “As Trustee For.” See the Payable on Death section for more detail.

Altering and Closing Your Revocable Living Trust

Since your trust is a dynamic system, it is important to periodically review it and make decisions about the trust based on any changes in your life. As long as you are capable, you are free to alter or close (revoke) the trust whenever you want.

There will be many times when you will need to alter the trust. If you have a joint trust, both of you must agree with the changes. By not updating your trust, some of your assets may end up with an ex-spouse or in probate court when they are not accounted for. You can either amend the trust or completely redo it. This cannot be done by marking the changes on the original document, it must be done with a new document.

There will be many times when you will need to alter the trust. If you have a joint trust, both of you must agree with the changes. By not updating your trust, some of your assets may end up with an ex-spouse or in probate court when they are not accounted for. You can either amend the trust or completely redo it. This cannot be done by marking the changes on the original document, it must be done with a new document.

You will need to alter the trust:

- Whenever there are significant changes in your life, such as:

- Marriage or divorce;

- Birth or adoption of a child;

- You are diagnosed with a terminal illness; and/or

- You retire.

- If you want to add a beneficiary or designate contingent beneficiaries;

- When a beneficiary or trustee changes names or dies;

- If you want to change a beneficiary, trustee or successor trustee, the way the property is distributed, which property is part of the trust, and/or your name;

- When you have sold assets or property or acquired new property or other assets that you want to add to the trust;

- When you want to alter specific provisions if your situation or goals for the trust change; and/or

- Inheritance laws in your state change or you move to a new state with different inheritance laws.

Amending Your Living Trust

Amending refers to additions to the trust and other minor changes. If the trust document was drafted properly, you will probably not need a separate document to amend your trust if you are simply adding more property or assets.

Minor changes could include adding a beneficiary due to birth or adoption, adding or removing specific bequests, changing who will serve as successor trustee, or updating a beneficiary’s or the successor trustee’s legal name due to marriage or divorce.

Minor changes could include adding a beneficiary due to birth or adoption, adding or removing specific bequests, changing who will serve as successor trustee, or updating a beneficiary’s or the successor trustee’s legal name due to marriage or divorce.

If you need an official document or have minor changes to your trust, use these steps — these are general recommendations because state laws vary on adding amendments to a trust.

- Review the trust document to familiarize yourself with the details and identify where the changes need to be made.

- Contact your estate planner or find trust amendment forms online if you want to do it yourself.

- A Trust Amendment is a document, similar to a codicil in a will, that can be used to change specific provisions of the trust and leave other provisions unchanged.

- If you use your estate planner or an online service, they should have the forms available for you.

- Forms can be found at Law Depot, US Legal, NOLO, or pdfFiller.

- Be as clear and detailed as possible.

- Specify the name of the trust and trustee, the original and amendment date, and exactly what you are changing.

- Like the original trust, you want the amendment to be accurate so your trustee will be able to understand and carry out your wishes about how the trust should be managed and your property distributed.

- Include specific language in the amendment.

Locate where it states that you have the power to amend the trust in the original trust document. Note what amendments you are able to make and record it in the amendment document.

Locate where it states that you have the power to amend the trust in the original trust document. Note what amendments you are able to make and record it in the amendment document.- Title the document, such as “Amendment to the [your name] Revocable Living Trust” dated [original creation date].

- Include language expressing your intention to amend the trust, such as “I hereby amend this trust as follows,” and whether this is an addition, deletion, or replacement for something in the original trust.

- Amend or add an entire paragraph by specifying the paragraph you intend to change (e.g. Division I, paragraph (a)), followed by the new trust language such as I designate [name of person] as my successor trustee.

- Delete an entire paragraph by specifying the paragraph.

- Include language to indicate that you want the rest of the trust language to remain unchanged.

- Have the amendment notarized.

- You must date and sign the bottom of the amendment as the trustee in the presence of a notary.

- Make sure both you and your spouse sign the amendment in the presence of a notary if it is a joint trust.

- Notaries usually charge a fee for each signature.

- Include witnesses signatures if your state requires it.

- You must date and sign the bottom of the amendment as the trustee in the presence of a notary.

- Make several copies and attach the original amendment form to the original trust document and keep them together in a safe place.

- Keep the amendment in the same place as your original trust document.

- Be sure you pick a place that will be easy for your successor trustee to access.

- In general, you don’t want to keep your trust or amendment in a safe deposit box unless you transfer the safe deposit box itself to the living trust or the trustee is an authorized user.

- If you don’t, the contents of the safe deposit box will be sealed by the probate court during the probate process and your trustee won’t have access.

- This can cause additional time and expense.

- Inform your successor trustee of any changes and send them a copy.

Restating Your Living Trust

Restating your trust involves making a document stating that you are not revoking the original trust agreement but are restating or redoing it with some amendments. Restating your trust is preferable if you make anything more than simple changes. It might be better to redo the entire trust if you:

- Have already amended the trust 2-3 times or more;

- Make significant changes to the trust, such as adding a new spouse as a beneficiary, eliminating a beneficiary, removing an important asset, or a major change in distributions, such as from family members to a charity;

- If your state’s laws governing revocable living trusts have changed or you move to a new state; and/or

- If there is any change in federal or state inheritance law that would require you to restructure your trust.

An Amendment and Restatement of Trust is a document that will completely replace and supersede all of the provisions of the original trust. This avoids the confusion that would happen if multiple amendments were added. Title the document, such as “Restatement of the [your name] Revocable Living Trust” dated [original creation date].

There are two options. A document that:

- Lists the amendments along with a statement saying that all other provisions of your trust remain the same; or

- Repeats the contents of your original trust agreement while incorporating your changes.

- The trust is rewritten as a new document with the necessary changes.

- This may be a better option for your subsequent trustee who only has to look at one document to get all the details of your trust.

The restatement does not nullify the original trust, but reworks it in a way that allows all of your assets and property to remain in the trust and avoids changing ownership on titles and deeds to a new trust.

You will likely want ran estate planner to help you.

Trust Restatement Forms can be found at LawDepot, Pennyborn, RocketLawyer, and US Legal Forms.

Revoking Your Living Trust

You can cancel your revocable trust at any time. If it is a joint trust, either of you can decide to revoke the trust. There are a number of reasons you may choose to do this, such as:

You can cancel your revocable trust at any time. If it is a joint trust, either of you can decide to revoke the trust. There are a number of reasons you may choose to do this, such as:

- The trust was created as a single trust and you want to create a joint trust with a new spouse;

- The trust was created as a joint document and you are getting a divorce;

- You are making so many changes that it would just be easier to terminate the trust and create a new one than to try to amend the previous one; and/or

- You would prefer to rather than appoint a new trustee or significantly change the provisions of the trust, although it will involve transferring assets to the new trust and changing the ownership on deeds and titles.

If you decide to terminate the trust for any reason, you must first remove all the assets from the trust.

You then need to put your intent to revoke it in writing using the appropriate document, such as an official document of dissolution.

- Title the document, such as “Revocation of the [your name] Revocable Living Trust” dated [original creation date].

- The document needs to include the name of the trust, date of creation and revocation, your and any co-trustees signature, and notarization.

- Like the other documents, the language is important and should be checked by a professional.

- You must file the document with the same court as the original trust was filed.

After closing the trust, notify the beneficiaries and change the owner on any deed or title such as real estate, bank accounts, securities, business interests, safety deposit boxes, vehicles, copyrights, patents, and other personal property.

If you transferred everything back into your name, you need a new plan to have these items pass to the beneficiaries such as a will. You can also create another trust and change the ownership to that trust. This will also require changing the owner on any deed or title of assets transferred into the new trust.

You may need to file a final tax return for the trust if it earned more than $600 in income.

Revocation of Living Trust Forms can be found at Free Printable Legal Forms, NOLO, Rocket Lawyer, or pdfFiller.

Income Trusts

Income trusts are an estate planning strategy that transfers assets to family members in a way that can reduce gift or capital gains taxes while providing you an income from the growth of the trust while it exists.

- These are living trusts that can be revocable and managed by you as trustee or irrevocable and be managed by a trustee on your behalf.

- They are best used for assets that are capable of producing high gains, especially a business or income producing property (i.e. rentals).

- If created as an irrevocable trust, they can minimize estate taxes by removing these assets from your estate by transferring ownership to the trust and freezing the value of the asset at what was when the asset was transferred until it is transferred to your beneficiaries.

- Any capital gains are only due when the assets are sold by your beneficiaries.

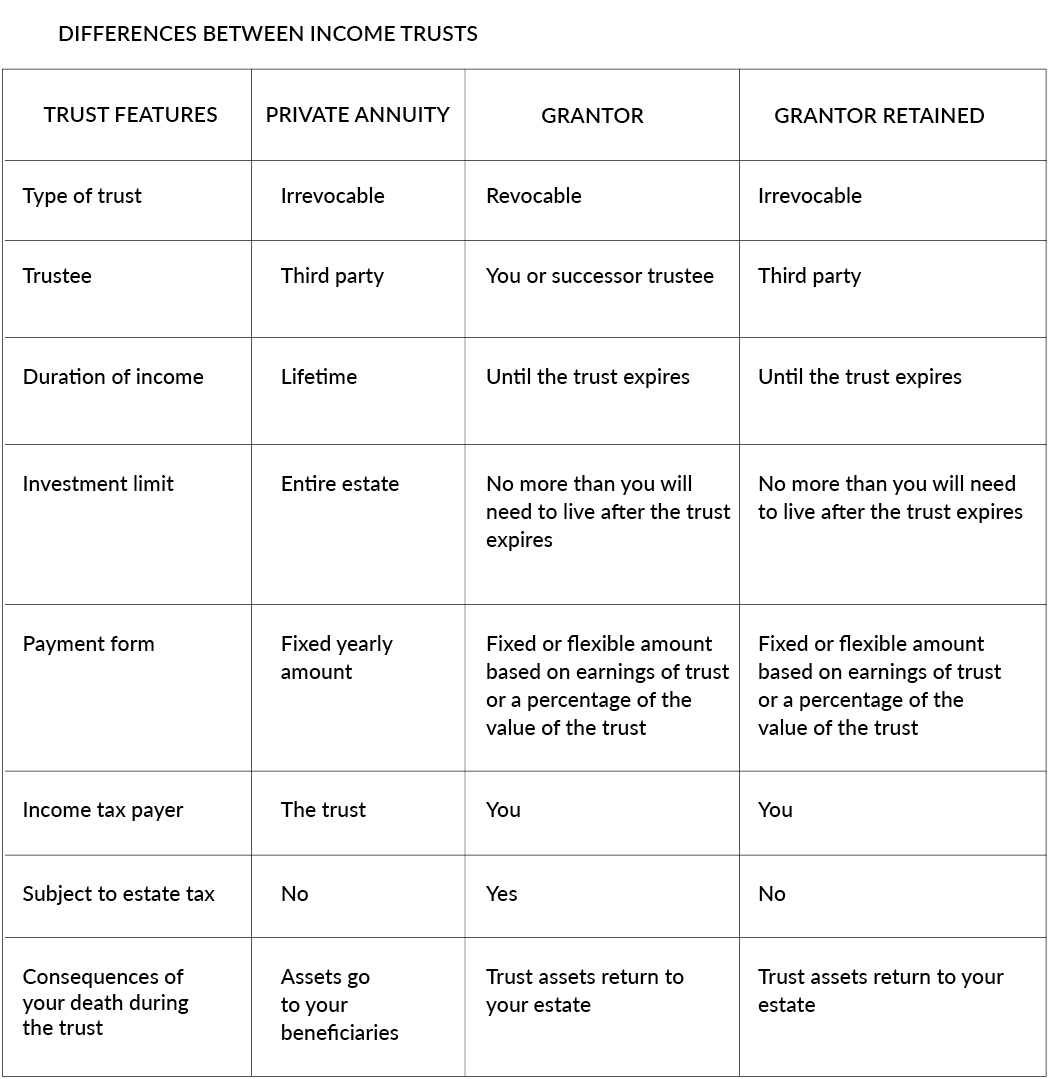

There are three types depending on the duration of the trust and whether or not they are revocable.

- A Private Annuity Trust is irrevocable and exists until your death and is transferred to your beneficiaries after that.

- A Grantor Trust is revocable, exists for a specific time period, and is transferred to your beneficiaries after it expires.

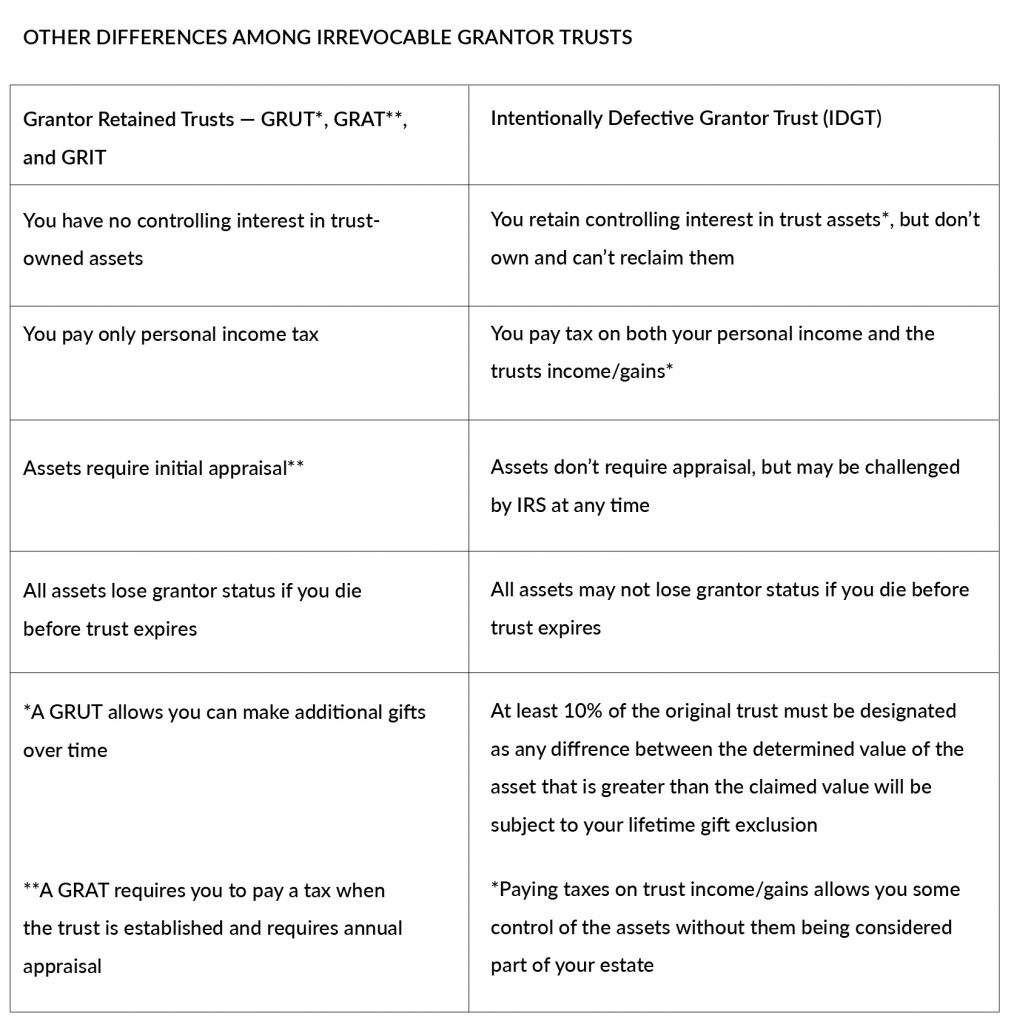

- A Grantor Retained Income Trust is irrevocable, exists for a specific time period, and is transferred to your beneficiaries after it expires. There are four forms of GRITs, a Grantor Retained Annuity Trust (GRAT), a Grantor Retained Unitrust (GRUT), Grantor Retained Income Trust (GRIT), and an Intentionally Defective Grantor Trust (IDGT).

Private Annuity Trusts

A private annuity trust can be used for asset protection (estate freeze). It is an agreement in which you (the settlor) transfer/sell property or assets to another person (the trustee) in the form of a trust in return for regular payments to you. This is usually a child or other relative, but could be a coworker you want to leave your business to. This is different from other types of annuities involving financial institutions that will provide income during retirement for turning your assets over to them.

A private annuity trust can be used for asset protection (estate freeze). It is an agreement in which you (the settlor) transfer/sell property or assets to another person (the trustee) in the form of a trust in return for regular payments to you. This is usually a child or other relative, but could be a coworker you want to leave your business to. This is different from other types of annuities involving financial institutions that will provide income during retirement for turning your assets over to them.

A private annuity trust will exist as long as you are alive. You can put your entire estate into the trust, except any assets funded with pre-tax dollars, such as traditional IRAs and 401(k)s. You will receive a fixed yearly income based on the probable earnings of the trust until your death. The trust will then be transferred to your beneficiaries.

An annuity trust is best reserved for assets that will produce capital gains and/or will have significant appreciation over time to allow you to have a good income.

- The assets could include your business interests, stocks, home and other real estate, securities, or other types of assets that will increase in value over time.

- Avoid using assets that may have liens or be at risk for depreciation or investment credit recapture.

The major goal of the private annuity trust is to defer capital gains, but it can reduce gift taxes and estate taxes for your estate. Although you will need to pay a capital gains tax at the time of transfer to the trust, the annuity will have the effect of decreasing further capital gains taxes since the assets, including any growth, are no longer part of your taxable estate.

The value of the asset is the fair market value (FMV) assessed at the time the annuity trust is created, so you will need an assessor. Assessor’s and other fees, such as legal or accountant fees, can make setting up an annuity expensive.

Because the private annuity essentially makes the transfer a sale rather than a gift, the transfer is not subject to a gift tax. However, this is not true if the value of the annuity is less than the FMV when the difference is considered a gift to the beneficiary/obligor.

After transfer of assets, the obligor agrees to make payments to you based on the terms of the annuity trust to provide you with an income. Payments will be subject to income tax.

If the annuity trust is transferred to your beneficiaries or a trust in their name, there will be no capital gains tax if the annuity increased in value or estate tax. Your beneficiaries would only pay capital gains tax if they sell the assets and there were capital gains that accrued after your death.

Grantor Trusts

A Grantor Trust is a form of estate freeze that allows you to receive income from the assets and interest earned by the trust for the life of the trust while fixing the value of the assets at what they were worth when the trust was formed.

The trust is a separate legal entity where you (the grantor), not your estate, are the owner of the assets and property for income and estate tax purposes while the trust exists. You pay income taxes on the funds received. This is an advantage since individual income tax rates are lower than the rates for trusts.

You could also use Grantor Trusts to leave a significant amount of assets in the trust to transfer to your beneficiaries after the trust expires without affecting your lifetime gift exclusion or being subject to estate tax.

Unlike a private annuity trust, grantor trusts only exist for a limited time, typically 2-10 years. The choice of the trust duration needs to balance the fact that with a longer investment there will be more growth and the risk of dying while the trust exists. If the goal is to have the remainder of the trust go to your beneficiaries while you are alive, it is important to make sure the trust expires before you die. You would not want to put your entire estate into the trust, since it would leave you with nothing when it expires.

Grantor trusts are most effective when funded with assets that may appreciate significantly over time, such as shares of a family business, pre-IPO stocks, or other assets that can be transferred to high-yield investments. Grantor trusts are less effective if the assets depreciate during the duration of the trust.

You will want to put enough assets in the trust that the revenue generated is enough to live off of, but not enough to result in significant gains in the trust that you cannot take advantage of. This would make your family responsible for any capital gains that occurred during the duration of the trust and have to pay capital gains tax on any assets sold.

There are consequences if you die before the trust expires. The assets would no longer have grantor status and will become part of your taxable estate and be subject to estate tax. This, plus any professional fees to create and maintain the trust, will reduce the amount of the estate your beneficiaries inherit after your death. Since you may not have planned for this, these assets would probably require an intestate settlement to distribute the assets to your beneficiaries.

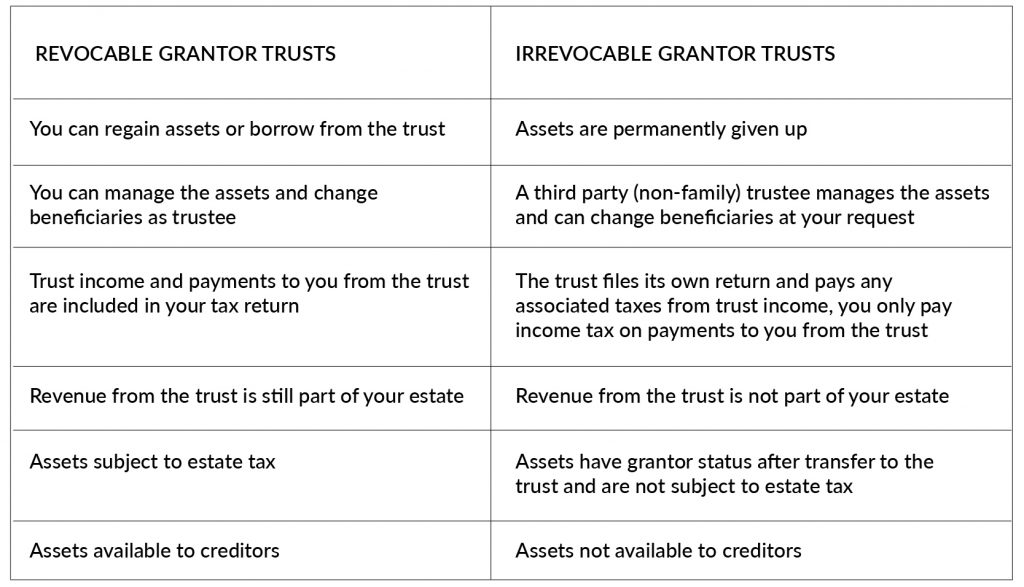

Grantor Trusts can be revocable or irrevocable. There are significant differences between them.

Revocable Grantor Trusts

This is the only form of grantor trust that is revocable. As a revocable trust you will be the owner/trustee and manage the assets of the trust, although you should name a successor trustee if you become unable to do this. You will be subject to 26 U.S. IRS Codes § 67-677 and §2035-2042.

- You will be able add or change the beneficiary of the trust, borrow from the trust without adequate security, use the income from the trust to pay life insurance premiums, and make changes to the trust’s composition by adding assets or substituting assets of equal value.

- As long as you remain the owner and the trust revocable, the assets are subject to estate tax.

- The income from your trust is reported on your IRS Form 1040 tax return under your own Social Security number. Any deductions would be claimed on the 1040 form as well. The trust does not file its own tax return.

- Since you can alter and manage the trust as you wish and you can choose how much, if any, you want to leave your beneficiaries in the trust when it expires.

When the trust expires any assets remaining either go to the beneficiaries tax-free or stay in the trust to benefit them.

When the trust expires any assets remaining either go to the beneficiaries tax-free or stay in the trust to benefit them.

A grantor trust can become irrevocable if you die or give up control to another trustee.

Under certain circumstances the Internal Revenue Service can consider any trust a grantor trust, such as if you have a reversionary interest greater than 5% of trust assets at the time the transfer of assets to the trust is made.

Irrevocable Grantor Trusts

- You can receive a percentage of the total value of the assets at creation of the trust.

- You can receive payments from interest earned by the trust.

- The income must be at least the minimal interest or section 750 rate on fair market value of the original trust assets. For a GRAT this rate is 120% of the mid-term applicable federal rate (AFR), a number published monthly by the IRS.

- Depending on the duration of the GRAT, this could pay out the entire value of the trust assets over the term of the GRAT. You may not want to choose this option if there is a chance of the trust underperforming.

- Beneficiaries will only receive assets if the trust outperforms expected growth rate used to calculate the annuity payment, so you are taking a risk if your goal is to leave them any assets.

- If the trust under performs, it will expire before the expected term and result in less income.

- The main advantage of a rolling-GRAT structure is that the principal remains in a trust for a longer period of time, although not in the same one it started in.

- The initial distributions roll into subsequent trusts (rather than being returned to you), and you receive larger distributions in the final years of the cumulative term.

- Rolling GRATs may provide a cushion market volatility, so for riskier investments, such as stocks, rolling GRATs may be preferred.

- An annual income of at least the minimal interest rate on the assets in the original trust (for an IDGT this rate is the current AFR); or

- The actual interest earned for the term of the loan followed by a lump sum payment when trust expires. This may be important for a business that needs reinvested capital to grow.

- Unlike other grantor trusts, it reduces the tax burden for your beneficiaries since the trust’s income taxes have already been paid by you;

- It is the best grantor trust to use to for children and grandchildren; and

- Assets, like real estate, investable assets like securities, collectibles, artwork and family heirlooms can be gifted to the trust. They may be subject to gift tax if their values exceed the limit, or “sold” to the trust, like a loan, to remove them from your estate and exchanged for a promissory note from the trust to pay interest, usually less than the actual expected income/gains, and repay over a specific time.

Assets sold to the trust are not subject to:

- Capital gains tax, since you’re essentially selling them to yourself; or

- Gift tax, since the assets are not considered gifts.

In all four forms you have the option of trying to use up the assets or leave some for your beneficiaries (must be family). If your plan is to leave assets for your family, you choose a percentage based on the amount you want to transfer to them when the trust expires.

A Qualified Personal Residence Trust (described above) is a type of irrevocable grantor trust that only contains your primary or secondary residence. Instead of a steady income, the trust allows you to live in or use the residence rent free for the duration of the trust. Like the assets in the other grantor trusts, the residence goes to your beneficiaries after the trust expires and returns to your estate if you die before then.

Steps to Get Ready to Create a Living Trust

Decide if a living trust is what is best for you. It may not be an ideal choice if:

Decide if a living trust is what is best for you. It may not be an ideal choice if:- Your estate is very simple and the probate process in your state is not complex;

- You do not have any other reasons to avoid probate court, such as significant debt;

- The cost of creating and managing the trust exceeds the benefits of having one; and/or

- Most of your assets will automatically transfer to your beneficiaries, such as joint ownership, payable on death accounts, transfer on death deeds; annuities, and retirement accounts; and/or

- Your estate does not exceed the federal and/or state estate tax limit.

- Make a list of all the assets you have and collect all the paperwork or files.

- Include everything from tangible items such as your house or other real estate, car, and jewelry, to intangible items such as bank accounts, stocks and bonds.

- Life insurance policies, IRAs (Individual Retirement Accounts), annuities, and any account or asset that can name the trust as beneficiary. They are not eligible for inclusion in the trust if other beneficiaries are named.

- Other things that can be included are royalties, copyrights, patents, trademarks, loans/debts owed to you, and gas, oil and mineral rights.

- Omit any property that is jointly owned or you would prefer to be given using a payable on death account or transfer on death deed. Although it can confuse things if there are discrepancies, the beneficiary designations on these documents usually supersede the trust beneficiary designations.

- Consider the type of trust that is appropriate for your situation.

- You may want to consider a joint trust if you are married.

- You can either control the trust yourself or opt to have another trustee control it.

- Decide what you want your trust to do. This can include providing an income, protecting assets from creditors or certain taxes, qualifying for medicaid, passing assets to heirs, or giving to charity. You can create one trust to accomplish all of your goals or create additional trusts if necessary for specific purposes, such as an income trust, a special needs trust, a Miller trust, or a charitable trust.

- Choose the beneficiaries.

- A trust must have a purpose, usually to pass assets on to your beneficiaries.

- These will usually be family and friends but may be organizations (including charities) that will receive assets upon your death.

- You may want to decide on those who you don’t want to include and the reasons why.

- Since a trust can only control assets placed into it, you must decide on the specific assets you want to add.

- These are usually large assets such as your investments, businesses, home or other real estate, and possessions. Life insurance, certain retirement accounts, and other assets that already name beneficiaries are not usually added.

- You will need to get assessments of the fair market value of items of personal property before adding them.

- Decide on a trustee – You can either name yourself as the trustee that controls your assets during the course of your lifetime (revocable trust) or name a trustee to manage the estate (irrevocable trust).

- If you are the trustee, you will want to name a successor trustee if you become incompacitated and unable to manage the trust.

- If you choose another trustee, decide on a successor trustee in case something happens to prevent your first choice from performing their duties.

- You can choose either someone you know, family or friend, or a bank or trust company. Both are entitled to a fee, although an institution is likely to charge more.

- Consider and include instructions about how you would like the trustee to manage individual assets.

- You need to consider the likely possibility that circumstances can change and issues may arise that require different actions of the trustee than those specified in the trust. These may include:

- What is added to the trust;

- How the trust money is to be spent, including who will receive income and how much; and/or

- Investments to be made with the trust.

- While you can include any level of detail to guide the trustee in handling financial matters and adapting to changes, you won’t be able to anticipate everything.

- There are two ways a trustee can adapt to these changes and deal with unexpected issues.

- They can ignore your instructions, since there is no legal obligation to do so.

- You can officially give them the power to make changes.

- You need to consider the likely possibility that circumstances can change and issues may arise that require different actions of the trustee than those specified in the trust. These may include:

- Decide how you will direct the trustee regarding how, what amount of, and when your assets will be dispersed to each beneficiary and who will control them after the trust is transferred to the beneficiaries.

- Assets can be transferred entirely to your beneficiaries or can be spread out over time, in which case disbursement may also include interest/earnings/gains from the trust.

- You may want toconfer with your beneficiaries before deciding on unequal distribution of assets.

- Consider whether your beneficiaries are capable of managing the assets or need them to be managed by a trustee or financial professional and at what age they might be able to.

- Assets can be transferred entirely to your beneficiaries or can be spread out over time, in which case disbursement may also include interest/earnings/gains from the trust.

- Choose a guardian for your minor children.

- You cannot designate a guardian through a living trust, but you still need to consider who you would want to take care of them in case both you and your spouse die.

- The guardian can be designated in a “pour-over will,” which should be created at the same time as a living trust. A pour-over will provides for the distribution of any new assets not added to your living trust before your death or any assets inadvertently excluded.

- If you do not want this guardian to manage your children’s inherited property, you will need to name another adult with the authority to do so. This person can be a trustee, property guardian, or property custodian under the Uniform Transfers to Minors Act.

- After doing the above steps you should have a good idea of how complex your trust will be and whether you want to try and set up your own trust or have it done professionally.

- Trusts are more complicated than wills, and like wills, you should only attempt to do it yourself if the process will be relatively simple.

- If you opt to create your own you can usually find the appropriate forms or online program to do so. See the Resources section below.

Creating a Living Trust

To create a revocable living trust you, known as the grantor, settlor or trustor, need to have a viable document called a Trust Agreement, Declaration of Trust, Deed of Trust, or Trust Deed. You could begin by filling out a living trust form appropriate for your state, using appropriate software, or going to a professional estate planner. Consult an attorney or other estate planner if you are not completely sure you can do it yourself.

A living trust is not only a document, but a dynamic financial investment that must be actively managed. It can be a laborious undertaking and there are many details to know to make your trust valid.

A living trust is not only a document, but a dynamic financial investment that must be actively managed. It can be a laborious undertaking and there are many details to know to make your trust valid.

- You will need to provide legal proof that you intended to transfer your control of your property to the trust and/or trustee for the express benefit of your beneficiaries.

- You must declare that you personally decided that the relevant assets were to be used in the trust.

- This is to confirm that making the trust, transferring control, and placing assets in the trust was intentional, i.e. of your own free will.

- A trust could be considered invalid if this is not stated properly.

- The correct language is necessary to make your instructions in the trust a legal obligation, rather than just a statement of your wishes and hopes for it (Precatory Language).

- The owners of the trust must sign the document in front of a notary public. Some states require witnesses as well.

- To sufficiently fund the trust and make it viable you will need to make either yourself as trustee or the trust itself the owner of each asset. You can either change the ownership on the existing documents or create new ones.

- You must either change property ownership on the existing deed, title, or other ownership documents or create new ones.

- You need to transfer ownership of financial accounts to the trust as well as making the trust or trustee the beneficiary for any asset that names one.

- A bank account must be opened for the trust.

- Your trust document doesn’t need to be filed with a court or any government agency, but should be stored in a safe place that is known and easily accessible by all trustees for when proof of ownership is needed. If you had the trust done professionally, they will also have a copy of the trust document.

- You need to update assets, trustees and beneficiaries when necessary.

Transferring Assets to a Living Trust

To have a viable and effective living trust you should transfer and continue to add most of your property and other assets into it before you die. This is crucial since most courts can decide to dissolve a trust that is worth less than the amount of money needed to distribute the trust property. States may even have a law that dissolves a trust if it does not have the minimum value in funds or property specified in that state law.

The transfer methods depend on the asset, but there are two basic ways: reassign ownership rights or change the title/deed.

In each case the ownership should reflect your choice of either the trust itself or the trustee on behalf of the trust.

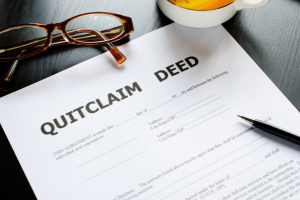

Real estate such as your home can be transferred using a quitclaim deed. An alternative is a warranty deed which ensures you have good title by pledging or warranting that you own the property free and clear of any outstanding liens, mortgages, or other encumbrances against it. When you transfer the deed, it may make it easier for your trust beneficiaries to sell the home at a later date.

Real estate such as your home can be transferred using a quitclaim deed. An alternative is a warranty deed which ensures you have good title by pledging or warranting that you own the property free and clear of any outstanding liens, mortgages, or other encumbrances against it. When you transfer the deed, it may make it easier for your trust beneficiaries to sell the home at a later date.

- The deeds will be specific to the state where the property is located, require witnesses, notarization, and filing with the appropriate agency and a transfer tax and other fees. Some states exempt the transfer to a living trust, some charge a nominal fee, while others consider it a sale at full market value and assess the full taxes and fees.

- You must file any new real estate deed with your county.

- You may need to file a copy of the trust document or a summary of the trust (a memorandum of trust or certificate of trust) to the court.

- This summary is preferable because it is typically one or two pages and avoids having the details of the trust document in the public record.

- The filing is usually associated with a filing fee.

- If you have a mortgage on your property, transferring the deed should not affect your mortgage.

- If you have a mortgage due on sale provision, you may need to obtain the permission of the lender.

- If you have title insurance, you should check with your agent. You may be able to transfer it to the trust, but some title insurance companies require that the trust buy a new title insurance policy.

- You may need to change your homeowner’s insurance to show that the trust is now the owner of the property.