Testamentary Trusts

Updated: December 30, 2022

A testamentary trust (a.k.a. will trust) is a type of trust that, like a will, is created to transfer your assets to your beneficiaries according to your wishes after you die. Unlike a will, the trust allows you to add provisions that will specify when and how the assets are distributed by the trustee and/or used by the beneficiaries. A provision can be added to give the trustee some discretion over disbursement that allows them to adapt to changing conditions.

Characteristics of a testamentary trust include:

- It is a type of family trust if done on behalf of your heirs;

- It may be most useful for young children and beneficiaries that might misuse the assets or who lack responsibility;

- It is not a living trust as it exists only after your death; and

- They are irrevocable (cannot be changed) unless otherwise specified.

The trust has its own IRS tax identification number and any income or capital gains tax on the trust’s earnings are paid for by the trust.

A testamentary trust comes with many perks.

- Your beneficiaries don’t pay taxes on income distributed from the original trust assets, which have already been taxed, but do if the income is distributed from the trusts interest earnings or capital gains.

- The assets are protected from creditors and legal actions.

- The trust does not affect the amount of your beneficiary’s pension when they reach retirement age.

- The trust can help avoid taxes on any proceeds from life insurance payments by adding them to the trust.

- The trust is essentially a payable on death account that may help reduce estate taxes.

A testamentary trust would be planned by you and is usually for your minor children and dependents or family members with disabilities, any of whom may not be able to manage assets. You can create a testamentary trust for anyone. Depending on your needs, there may be multiple testamentary trusts in your will or living trust.

Standard Testamentary Trust

The usual method is to create an identical trust for each beneficiary. If you do not want to create similar individual trusts for each child or need a trust for a specific purpose, there are other trusts to choose from, depending on the person and the situation.

- The trust should include specific details that direct how and when the assets may be available to beneficiaries. For example, you can designate that assets must be:

- Dispersed or sprinkled over a certain time, at a certain age, in specific amounts, or at certain intervals; or

- Used for educational expenses or a downpayment on a house.

- Each beneficiary is a beneficial owner and is entitled to a certain proportion of the trust income, depending on the terms of the trust. This may include receiving a monthly allowance, receiving the money at a certain age, or claiming funds at any time.

- The trust will usually set an expiration date when the beneficiary receives the balance left in the trust. This usually depends on the beneficiary and the situation.

- Trusts for minor children cannot expire until they reach the age of maturity, typically 18 years old.

- A special needs trust for a disabled beneficiary may have no expiration date as long as the trust is funded or only expires when other resources like Medicaid, Medicare, Social Security, or Welfare become available.

- Other expiration dates are discretionary but may include: the beneficiary turns 25 years old, graduates from college, or gets married. You may want to leave it up to the discretion of the trustee as to when the beneficiary is ready, but 35 years old is the limit.

- If created in your will, the executor is theoretically responsible for naming the trustee but you can designate one if you want a different person.

- Some of these trusts, such as the discretionary trust and stand-alone third-party special needs trust, can be created for use while you are alive.

It is possible to create a testamentary trust in either your will or a living trust (rarely). This is done by including the testamentary trust details in your will or a clause in a living trust. You can alter the terms of the testamentary trust while you are alive by updating your living trust, will, or the appropriate codicil.

It is possible to create a testamentary trust in either your will or a living trust (rarely). This is done by including the testamentary trust details in your will or a clause in a living trust. You can alter the terms of the testamentary trust while you are alive by updating your living trust, will, or the appropriate codicil.

- Your executor will be responsible for creating the trust according to your instructions in the will; and

- The details of the trust are part of the probate process.

- The entire trust is visible to the probate court and therefore a part of the public record available for anyone to access. This could be an issue if you do not want your beneficiaries to know the details of another beneficiary’s trust.

- Since you were still in control of your assets at the time of your death they will be subject to estate taxes.

- Technically, the trust will not exist until your will is validated and the probate process is completed, which can be a lengthy process. Occasionally it is long enough that some of the terms of the trust such as reaching a certain age may not be an issue, or may even render the entire trust no longer relevant.

- The probate court continues to oversee any trusts created in a will to make sure it is being handled properly right up until it expires. This involves legal fees, so you need to consider the eventual cost when deciding whether to create a testamentary trust in your will and when the trust expires.

- Your trustee will be responsible for creating the trust according to your instructions in the living trust; and

- The testamentary trust will not be subject to the probate process.

- The details of the trust are not part of the public record.

- Since the assets were in the control of the trustee at the time of your death your assets will not be subject to estate taxes.

- The trust will exist and be valid as soon as the trustee moves the assets.

- There will be no outside oversight of the trust or legal fees associated with the probate process.

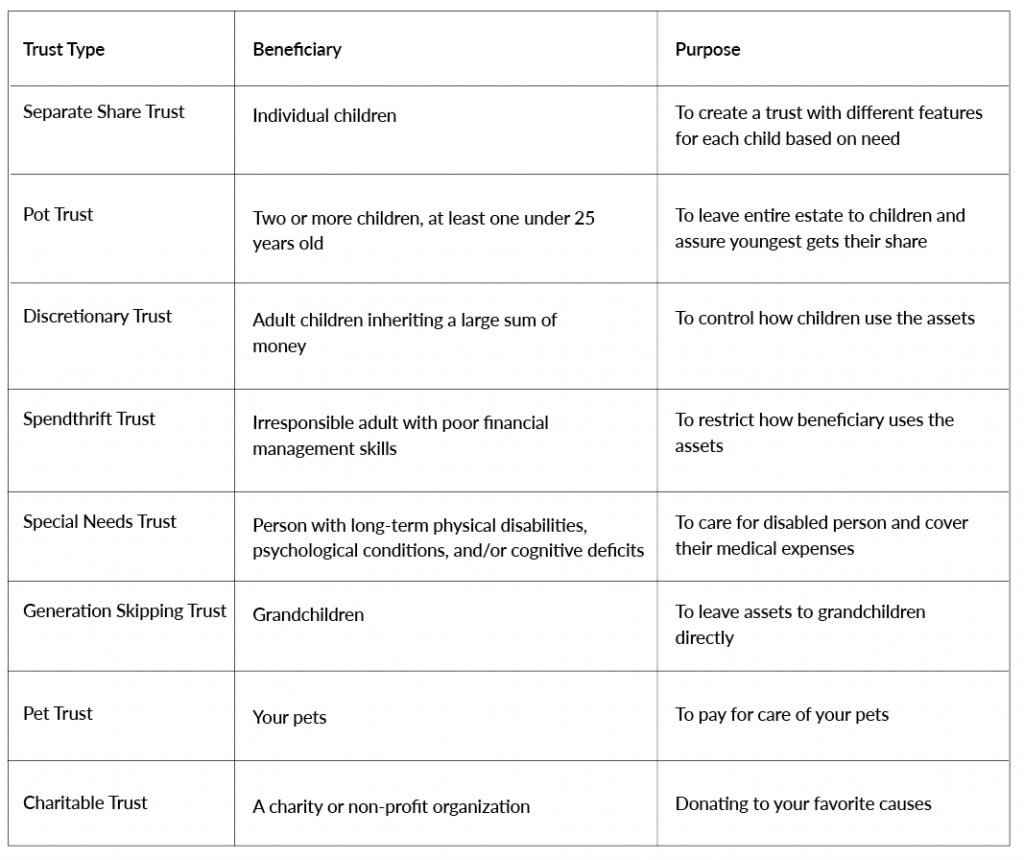

Other Types of Testamentary Trusts

If you do not want to create similar individual trusts for each child or need a trust for a specific purpose, there are a number of other types of testamentary trusts. The predominant differences are the nature of the beneficiary and the goal of the trust.

Individual/Separate Share Trust

A Separate Share Trust is similar to the standard testamentary trust, but with each child’s trust having different assets and features specific to their situation and needs.

A Separate Share Trust is similar to the standard testamentary trust, but with each child’s trust having different assets and features specific to their situation and needs.

Because receiving different amounts of your assets can create resentment among siblings, especially if created in your will when each child can learn what the other is inheriting, it may be best to discuss it with them beforehand. It is a form of Sprinkling Trust.

Pot Trust

A Pot Trust, also called a Family Testamentary Trust, is a trust that can be created if you have two or more children with at least one of them under 25 years old and you are leaving your entire estate to your children. It is also a form of Sprinkling Trust.

The Pot Trust is a single trust that includes all of your children and it gives the trustee discretion over how to spend money on each child. It precludes the creation of individual/separate trusts for each child.

- Since spending can be based on the children’s specific needs, the trustee can use resources for any child’s unforeseen needs such as a medical emergency or educational expenses.

- Having one trust is less time-consuming for the trustee who won’t need to keep detailed records on multiple trusts. However, it may require them to make difficult choices resulting in an unequal distribution of assets to each child and deal with any discord that may cause.

A Pot Trust typically ends when the youngest child reaches the age of majority (18 or 21, depending on the state) and is split evenly among them.

- You could opt for the trust to be continued until the youngest child reaches a certain specified age, up to 25 years old.

- This may be difficult for much older siblings who may have to wait a long time to get their share of your assets, but assures that the youngest child gets their share.

It is less expensive to set-up and manage a single pot trust than having multiple individual trusts when you have more than one child.

Discretionary Trust

A discretionary trust may be necessary when you are concerned about how a beneficiary will use their trust assets. The trust is basically a detailed plan for how the inheritance is used. To protect the assets from the beneficiary, the trust will have a designated trustee other than the beneficiary. Rules for discretionary trusts vary by state, so it is important to consult a professional.

You can consider a standard testamentary trust created for minors to be a discretionary trust since minors cannot manage financial interests. In this case, you need the trustee or conservator to use your instructions and their discretion to manage the trust for them and use it to provide for their needs.

A discretionary trust is created using a discretionary deed of trust and usually chosen for a spouse or adult children inheriting a large sum of money.

- Although discretionary trusts can be created and used while you are still alive, they are most commonly used for assets that go to beneficiaries upon your death

- These include assets in your will, a living trust, or payable on death accounts, like bank accounts, certificates of deposit (CDs), money markets, or a life insurance settlement, that name the trust as beneficiary.

- In addition to stipulating when the trust expires and when/how the beneficiary receives the remaining assets, you can specify:

- How much money the beneficiary can get at one time and the intervals between the gifts;

- What the money can be used for, such as education, medical bills, every day expenses, etc.; and

- The age they can start to receive money.

- Unlike the standard testamentary trust, there is no age limit on when the funds assets have to be transferred to the beneficiary, so the trust can be a lifetime trust.

This is typically done to protect assets from a beneficiary’s poor money-management skills, extravagant spending habits, gambling or drug habit, personal or professional creditors, lawsuits, divorced spouses, predator’s/scams, etc.

- With guidance from details in the trust, the trustee has full discretion of the distribution of money and assets to the beneficiaries. However, they are not obligated to follow your guidance.

- As long as the trust exists, the funds are not part of your beneficiaries’ estates. They have no individual access to the funds and cannot claim or demand money from it.

- Like many trusts, a discretionary trust can be designed to minimize estate taxes since the trust assets pass directly to the beneficiaries.

- You can designate future beneficiaries for any assets remaining after your beneficiaries death, such as a grandchild.

A trustee is chosen who can name beneficiaries if they are otherwise unspecified and has complete control to manage the finances until a pre-specified time, until the beneficiaries are capable of managing them as determined by the trustee, or the lifetime of the beneficiary.

A trustee is chosen who can name beneficiaries if they are otherwise unspecified and has complete control to manage the finances until a pre-specified time, until the beneficiaries are capable of managing them as determined by the trustee, or the lifetime of the beneficiary.

- The trust/trustee is protecting your estate by protecting the beneficiary from themselves.

- You will be able to add provisions to protect assets from creditors and to provide any guidance, such as a letter of intent, to the trustee you deem necessary, consistent with established bankruptcy and creditor protection laws.

- You may want to arrange for oversight of the trustee. This may done by:

- Having one or more “appointer” with the power to remove the trustee and appoint a new one; or

- Appoint a guardian who has the power to veto your trustee’s decisions.

Spendthrift Trust

A spendthrift trust may be allowed in some states. It can be either and irrevocable living trust that can be used while you are alive and after your death when it becomes testamentary or a testamentary trust created in your will. It is specifically created to protect the assets of a beneficiary from themselves. These are typically people that:

- Have poor or irresponsible money management skills and tend to run up large debts;

- Have an addiction that could cause them to use up money quickly;

- Might be easily deceived or defrauded; or

- Have a gambling habit and might easily fall into debt with creditors, although some states put a limit on the amount of money that can be protected from creditors.

While a spendthrift trust can protect the trust’s assets from creditors:

- The Uniform Voidable Transaction Act, which applies in 44 states, including the District of Columbia, prohibits setting up a trust to specifically avoid your creditors; and

- Many states limit the amount of income generated from a trust that can be protected from creditors.

The spendthrift trust is most effective if it is also a discretionary trust, and the beneficiary has no right to the funds and can’t spend it before they actually receive it. Although the trust protects the portion of the inheritance that remains in it, the money that the beneficiary has received is available to creditors and others.

It can be a long-term trust and usually exists until the beneficiary becomes financially responsible enough to manage their inheritance responsibly. This may be a predetermined age that you dictate in the trust or at the discretion of the trustee. It may exist for their children to inherit if the beneficiary never becomes responsible enough.

The trust names an independent trustee to manage the trust to avoid assets being squandered, used unwisely, or claimed by creditors, frivolous lawsuits, and dishonest business partners. In addition to a spendthrift provision, such as No part of the income or principal of this trust shall be subject to anticipation, alienation, or assignment by any beneficiary, other provisions you could add to the trust may vary by state and include:

- Benefits in the form of a regular payment from the trust as determined by the trustee;

- Restricting what the beneficiary can spend trust funds on beyond basic needs and education;

- Giving the trustee the authority to determine what payments are needed, to make or give the beneficiary the money to do so, or to withhold payment;

- When and how property is used according to the trust agreement;

- Authorization for the trustee to buy needed goods or services for the beneficiary and make special payouts if they have certain justifiable large expenses, such as an illness or enrollment in college;

- Preventing the beneficiary from spending any trust fund money or using it for collateral without authorization of the trustee;

- Forbidding the beneficiary from selling their interest in the trust;

- When and how the trust should end when the beneficiary is ready; and/or

- Instructions for the trust principal if the beneficiary’s circumstances change, for example if they die or become responsible.

Spendthrift trusts cannot deny payment for many kinds of obligations, such as child support, alimony, and debts incurred for necessities of life such as food or shelter. Assets may not be protected from government claims, such as taxes.

Being the trustee of a spendthrift trust can be very stressful and often involves very difficult decisions, so take care with who you choose and leave detailed instructions that could ease the burden. Since the trust must be carefully tailored to the individuals involved and the spendthrift provision must be carefully worded, it is best to seek professional help.

Dynasty Trust

A dynasty trust is an irrevocable long-term trust that can pass wealth from generation to generation. As long as the trust exists, there are no estate, gift, and generation-skipping taxes when the trust grows and is used by the next generation of beneficiaries.

This is possible because the trust is perpetually held under the control of a trustee and is never transferred to another owner.

- The trustee is appointed by you as grantor or trust creator and is responsible for managing the funds according to the terms set forth in the trust document.

- Since the trust may span many generations, an institutional trustee, such as a financial services company or bank, is generally the best choice for a trustee.

You can take advantage of the estate tax/generation-skipping tax exemption, $12.920,000 in 2023 ($25,840,000 for married couples), when creating the trust.

- Additional funds can be added but you are taxed according to the generation-skipping transfer tax rate of 40%.

- When assets are placed in a properly established dynasty trust, the assets and their appreciation are not subject to federal estate/generation-skipping tax as long as the trust exists.

- While you are alive the dynasty trust can act as a grantor trust where you pay income taxes on the funds received. This is an advantage since individual income tax rates are lower than the rates for trusts.

Subsequent beneficiaries have access to the funds as laid out in the trust document, with the goal of keeping the trust funded for future generations. Although no further estate taxes are paid, all disbursements from the trust are subject to income taxes.

The major drawbacks to a dynasty trust are:

- The trustee maintains control of the trust for the duration of the trust;

- The long-term nature of the trust along with the inability to change it make it difficult to create — long-term economic trends are difficult to predict; and

- The irrevocable nature of the trust makes it inflexible for adapting to changing financial needs of the beneficiaries.

Dynasty trusts can split into individual trusts for subsequent beneficiaries, but it become unwieldy to manage the growing number of trusts

Most states set a limit for how long a dynasty trust can exist.

Pet Trusts

Although very much a part of our lives, we often forget about including our pets in our Estate Plan. While animals may not be able to inherit money or property, you can assure they can be cared for after you die or if you can no longer care for them. These pets may include: cats, dogs, birds, turtles, snakes, lizards, hamsters, and similar small animals. You could also set up a pet trust for larger animals, such as a horse.

Although very much a part of our lives, we often forget about including our pets in our Estate Plan. While animals may not be able to inherit money or property, you can assure they can be cared for after you die or if you can no longer care for them. These pets may include: cats, dogs, birds, turtles, snakes, lizards, hamsters, and similar small animals. You could also set up a pet trust for larger animals, such as a horse.

While you can leave your pet to a beneficiary in your will and include funds to care for them, you may have little control of how they take care of your pet or spend the money. A pet trust can allow you to do both.

The 1990 Uniform Probate Code stated that a trust for the care of your pets can be created in all states, although there is some state-to-state variation. For most states the terms of the trust is for the rest of a given pet’s life. Some limit the duration of the trust to 21 years after your death, others up to 90 years. The trust cannot include provisions to care for other pets your caretaker may acquire.

Like other types of trusts, a pet trust will appoint a trustee. You will also appoint a caretaker, that may be different from the trustee, who will have custody of your pet and be responsible for their day-to-day care. You can also appoint a separate trust protector or enforcer to make sure your wishes are carried out.

Like other personal representatives, it is best to discuss it with them and to choose an alternative.

Consider the number of pets you have, their age, health, standard of living, grooming needs, and other needs when estimating how much to put in the trust. If the amount seems excessive, your family can contest the amount.

There are many other considerations to think about when deciding on the terms of the trust.

- To avoid fraud, make sure you have an accurate way to identify your pet, such as a detailed description or embedded chip.

- You may want to provide very detailed instructions for the caregiver, such as favorite food and toys, ‘puppy play dates,’ walking habits, grooming, and sleeping arrangements.

- Include any medical information, including your preferred veterinarian.

- You can include instructions that the trust takes effect if you are no longer able to care for your pet.

- Who will be the beneficiary of any remaining money in the trust.

- What burial or cremation arrangements that you would prefer once your pet passes away.

Steps to Get Ready to Create a Testamentary Trust

Preparing to create a testamentary trust is similar to a living trust and involves finding all your assets and making decisions about the type of trust, trustee, and specific details of its contents.

Preparing to create a testamentary trust is similar to a living trust and involves finding all your assets and making decisions about the type of trust, trustee, and specific details of its contents.

- Make a list of all the assets you have.

- Include tangible items such as your house, car, and jewelry, and intangible items such as stocks, bonds, and patents.

- Include financial assets such as life insurance policies, retirement accounts, annuities, bank accounts, certificates of deposit (CDs), money markets, and any other financial assets you want to include by making the trust the beneficiary.

- Omit any financial assets or property that is jointly owned or you would prefer to be transferred using a transfer on death deed or payable on death account. Even if they were included, the beneficiary designation in the trust will be overridden by the beneficiary designation in the other document.

- Choose the type of trust that is appropriate for your situation, such as those described above.

- Choose the beneficiaries.

- This is usually family and friends but may include organizations (including charities) that will receive assets upon your death, as well as who will get what.

- You may want to decide on those who you don’t want to include and the reasons why.

- Decide on the specific assets, including amounts, that will go to each beneficiary.

- The decision will be known to all beneficiaries if the trust is created in your will.

- Even if created in a trust, where the decision is only available to the inheriting beneficiary, it is still better to discuss the distribution with all beneficiaries if it is to be unequal.

- Choose a trustee that will manage the estate.

- The trustee chosen should be a person, usually known to you or the executor, with integrity that can be trusted implicitly.

- The other qualities you would like to have in a trustee are the same as those laid out in Choosing an Executor and Trustees – Who to Choose.

- They should be aware of their duties before they agree to serve as trustee.

- Other qualities may be needed for some types of trusts, such as a Special Needs Trust or Spendthrift Trust.

- Consider and include instructions about how you would like the trustee to manage the trust and distribute individual assets.

You can either transfer assets directly to adult beneficiaries or leave instructions on how the assets are to be distributed and/or how they may be used.

You can either transfer assets directly to adult beneficiaries or leave instructions on how the assets are to be distributed and/or how they may be used.- Minor children cannot own assets; your trustee will need to control and manage the assets until they are at least 18 years old or reach another milestone, such as finishing college.

- While you can include any level of detail to guide the trustee in handling financial matters and adapting to changes, you won’t be able to anticipate everything. You need to consider the possibility that things can change and issues may arise that require different actions of the trustee other than those specified in the trust. These may include:

- Shifting needs of the beneficiaries over time;

- Changing dispersion of the trust if a beneficiary dies;

- Changes in what the beneficiaries have to spent their money on, such as medical bills instead of educational costs;

- Investments to be made with the trust; and/or

- When the trust expires.

- There are two ways a trustee can adapt to these changes and deal with unexpected issues:

- They can ignore your instructions, as there is no legal obligation for them to do so; or

- You can officially give them the power to ignore them.

- Choose a guardian for your minor children.

- You cannot designate a guardian through a trust. You need to consider who you would want to take care of them in case both you and your spouse die.

- A guardian can be designated in a pour-over will, which should be created at the same time as your living trust. This will provide for the distribution of any new assets not added to your living trust before your death or any assets inadvertently excluded.

Creating a Testamentary Trust

Although you will not be the person to create a testamentary trust, you must put all of the details necessary for your executor to do so in your will or in a living trust for the trustee who will settle it after your death.

- In whichever document you choose to request the creation of the trust, you must provide legal proof that you intended to transfer your control of your property to the trust and/or trustee for the express benefit of your beneficiaries. A trust created in a will is subject to probate oversight while one created in a living trust is not.

- You must declare that you personally decided that the relevant assets were to be used in the trust. This is to confirm that making the trust, transferring control, and placing assets in the trust was intentional, i.e. of your own free will.

- A trust could be considered invalid if these are not stated properly.

- The trust can only control assets that have been placed into it and in a manner that is explicitly outlined in this document.

- You will need to update beneficiaries and other details in your will or revocable living trust to create the trust if necessary when circumstances change while you are alive.

To create a testamentary trust, your trustee will need to have a viable document called a Trust Agreement, Deed of Trust, or Trust Deed. There are many forms available and they should choose ones that are appropriate for your state and situation.

Even though a testamentary trust is irrevocable, it can be a laborious undertaking for both the executor or trustee creating it after your death and the trustee managing it.

- The correct language is necessary to make your instructions in the trust a legal obligation, rather than just a statement of your wishes and hopes for it. A lawyer or other professional will be able to help you with this.

- Before the trust is created, your executor needs to get a death certificate and a letters testamentary from the probate authorizing them to act on your behalf — in this case to form the trust.

A testamentary trust is not only a document that must be done correctly, but a dynamic financial investment that must be actively managed.

Adding Assets to a Testamentary Trust

To have a viable and effective testamentary trust it must be sufficiently funded. The trustee will need to:

- Have assessments of the fair market value of any assets that will be transferred into the trust, including your personal property and other assets that are not jointly owned or do not have designated beneficiaries;

- Transfer these assets to the trust; and

- Change existing ownership documents/deeds/titles or to create new documents for each asset to indicate that the trust is the owner. The assets should be designated as owned by either the trust itself or the trustee on behalf of the trust.

Resources

- Free Legal Document website.

- Sample Children’s Trusts. NOLO website.

- Bales W. How Does a Pot Trust Work? The WealthAdvisor website. Posted: August 31, 2021. Accessed: December 28, 2021.

- Barrett T. How Does a Spendthrift Trust Differ from an Asset Protection Trust? Kiplinger website. Posted: August 6. 2021. Accessed: December 30, 2022.

- Depersio G. Do Trust Beneficiaries Pay Taxes? Investopedia website. Updated: March 14, 2022. Accessed: December 30, 2022.

- Dynasty Trust. Cornell Law School website. Updated: January 2022. Accessed: September 7, 2023.

- Fletcher R. Estate planning for pets ensures your wishes are honored. fiftyplus advocate website. Posted October 6, 2021. Accessed: December 30, 2022.

- Garber J. Protection for Beneficiaries Using Discretionary Trusts. the balance website. Updated: October 24, 2021. Accessed: December 30, 2022.

- Gordon J. Discretionary Trust – Explained. The Business Professor website. Updated: September 26, 2021. Accessed: December 30, 2022.

- Hicks P. Is a Testamentary Trust Right for You? trust & will website. Accessed: December 30, 2022.

- Hoyt P. Estate Planning for Pets: How to Protect Your Furry Friends. Kiplinger website. Posted: October 25, 2021. Accessed: December 30, 2022.

- Johnson J. What is a discretionary trust? FreeAdvice website. Updated: July 15, 2021. Accessed: December 30, 2022.

- Kagan J. Testamentary Trust: Definition, Examples, Pros and Cons. Investopedia website. Updated: August 24, 2021. Accessed: December 18, 2022. Accessed: December 30, 2022.

- Kaminsky M. 10 Things You Should Know About a Testamentary Trust. legalzoom website. Updated: November 10, 2022. Accessed: December 30, 2022.

- Kenton W. Dynasty Trust: Definition, Purposes, How It Works, and Tax Rules. Investopedia website. Updated: October 21, 2022. Accessed: January 5, 2023.

- Klimashousky D. What Is a Testamentary Trust? Smartasset website. Updated: August 4, 2022. Accessed: December 30, 2022.

- Koenig D. How spendthrift trusts can protect your wealth & family. Union Bank & Trust website. Posted: April 19, 2021. Accessed: December 30, 2022.

- Lake R. How Does a Pot Trust Work? SmartAsset website. Posted: August 30, 2021. Accessed: December 30, 2022.

- Lake R. What Is a Pet Trust? Thebalance website. Updated: November 20, 2021. Accessed: December 30, 2022.

- LaPonsie M. What’s a Testamentary Trust and How Do I Create One? US News and World Report website. Updated: July 14, 2022. Accessed: December 30, 2022.

- Next generation planning with dynasty trusts. Fidelity website. Posted: November 11, 2022. Accessed: January 5, 2023.

- Pet Trust Primer. ASPCA website. Accessed: December 30, 2022.

- Placing a Testamentary Trust in a Will. FindLaw website. Updated: May 16, 2022. Accessed: December 30, 2022.

- Randolph M. Pet Trusts. NOLO website. Accessed; December 30, 2022.

- Randolph M. Spendthrift Provisions in a Trust. AllLaw website. Accessed: January 3, 2022.

- Randolph M. Trusts for Children. AllLaw website. Accessed: January 3, 2022.

- Redmond J. What is a Pot Trust? wisegeek website. Updated: December 27, 2022. Accessed: December 30, 2022.

- Simmons-Hannibal B. Estate Planning for Pets | Making Arrangements for Your Pets. NOLO website. Accessed: December 30, 2022.

- Simmons-Hannibal B. Spendthrift Trusts. NOLO website. Accessed: December 30, 2022.

- Simmons-Hannibal B. Testamentary Trusts. NOLO website. Accessed: December 30, 2022.

- Suh E. What is a testamentary trust? Policygenius website. Updated: January 4, 2022. Accessed: December 30, 2022.

- Using a Pot Trust for Young Children. NOLO website. Accessed: December 30, 2022.

- What Are the Benefits of Having a Testamentary Trust? ElderLaw website. Updated: December 29, 2022. Accessed: December 30, 2022.

- What Is a Testamentary Trust? MetLife website. Updated: November 9, 2022. Accessed: December 30, 2022.